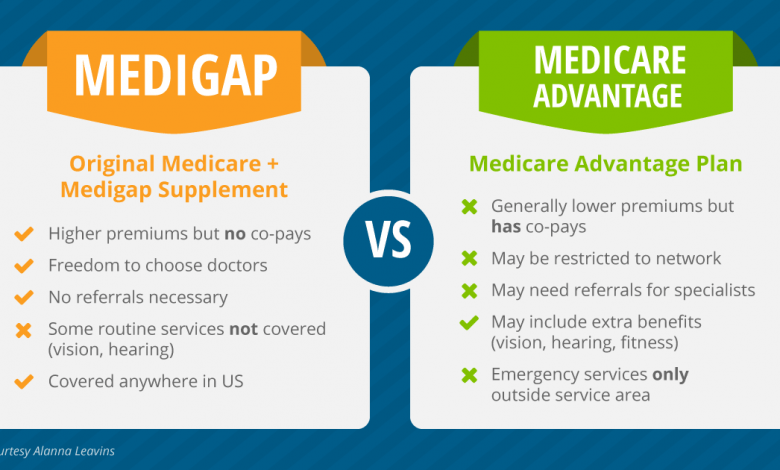

Differences Between Medicare Advantage and Medicare Supplement Plans

Medicare Advantage vs. Medicare Supplement

Medigap insurance gives you the extra coverage that is needed that does not come from Medicare. You might have wondered in the past, “what is Medigap,” well now is the time to learn. Medigap can pay for everything that Medicare does not pay for, and it can provide you with coverage that does not even allow for responsibility billing. You are covered right away. Read about enrollment for Medigap, and learn more about how Medigap differs from various Medicare Advantage plans. But, what exactly is Medigap and what does it cover? Medigap covers all of the following things:

- Medigap pays for all things that your Medicare does not pay for.

- Medigap is offered through private insurers that will charge a premium just to cover everything that is not handled by Medicare

- This type of insurance will pay for the claims instantly because any medical office can submit both the Medicare claim and the Medigap claim at the same time

Medigap is made to cover up for things that Medicare has already said that they do and do not cover. This is something that people get when they do not want to have to pay for the extra care that they get. They can get the claims filed as soon as their services have been offered, and they will be much more comfortable with the way that they are getting payments handled. Medigap was designed to make this as simple as possible because the Medigap plans all known what Medicare will pay for. The people who are on Medigap do not need to file their own claims so long as they have supplied their medical provider with information for their policy. However, they need to consider some other things that come up during the search process.

Is Medigap The Same As Supplementary Insurance?

Enrollment for Medigap is the same as supplemental insurance. Some people call it supplemental insurance because they remember the old days when there were not many of these different plans to choose from. People only had so much buying power, and now they have many options that have been re-branded as Medigap because it is a much more appealing name. Consider what has happened over the years to make supplemental insurance better:

- Supplemental insurance used to be something that was hard to find and too expensive. You might have paid more for the supplemental insurance than it was covering every year.

- The supplemental insurance plans that you get are geared specifically at Medicare. Is Medigap the same as supplementary insurance? It is now.

- Supplemental plans are administered by private companies that have it in their best interests to pay your claims quickly because they know they cannot keep you if your customer service is terrible.

You can search for both terms online when you are hunting for insurance, and you might look through regular insurance companies that you have had dealings with in the past. This means that you can work with a company you know, and you can be sure that they offer good customer service. You should also be very careful to pick companies that you believe are going to remain in this business for some time. No one wants to work with a private company that got in and out of the Medigap business in a couple years. You need better coverage and customer care in your golden years that is very consistent.

Medigap Covers Only Certain Things Because Of How Advantage Works

Medigap differs from Medicare Advantage because of how payments are made on these policies. You might have already asked, “is Medigap the same as supplementary insurance,” but you also need to ask if you need help with Medicare Advantage coverage. Medicare Advantage plans are paid on a monthly basis because they are often used for things like long-term care. You can get Medigap to cover these things, but you need to be very specific when talking to your insurance provider. You need to ask them if they have coverage for people on the advantage plans. And discuss with them if you will need to get a completely different plan when you do your enrollment for Medigap, as it relates to your personal needs. Someone who is getting a generic plan for Medigap might be surprised when it does not cover everything. Ask these questions when you are considering coverage beyond Medicare Advantage:

- You need to be told how Medigap differs from Medicare Advantage, and you need to be told if the company can cover anything extra that Advantage did not cover.

- You need to ask the carrier if they work with specific types of Medicare and Advantage plans. They might have their plan laid out to supplement certain carriers, and you need to be sure that you have coverage that will actually protect you over a long period of time. A company that

- Ask the company if they are willing to cover anything extra or make exemptions based on your needs.

Where Should You Look?

You can get information on the plans online, and be sure to look for carriers that have good reviews. Someone who is learning about the programs that they can get should look at the credit rating and customer service rating of each company they choose. You can pick a company that will not pass costs on to you, and you can also choose a company that actually knows how to build plans around Medicare. Be sure to find a company that will change their plans every year to meet the changes in Medicare, and you need to be certain that their level of coverage will go up every year because prices rise every year whether you like it or not.

Online Comparison Websites

You will come across some sites that put up the comparisons for you, and you can see which plans will help you the most. You might see the plans compared by their average ratings, or you might read articles that explain how these companies do what they do. The idea is to find the largest amount of information possible sot hat you can make an informed decision.

Customer Care

You have two options when you need customer care for supplemental insurance. You can contact the national Medicare call center, and you could call the insurance carriers you have selected for information. The national call center has a lot of information on both supplemental and Advantage plans. They have a keen understanding of how people are getting and using insurance because they want to be as helpful as possible. They can point you in the right direction most times, and they can show you which plans most other people use. You can do your research from there, and you will find that you can pick out the company that you think would be best for you. These companies are often hard to find open your own because you do not know where to start. Let the national call center guide you on what to do. You can call individual carriers to have them take you through the long list of coverage options that they have. They can let you know if they offer extra coverage for Advantage plans, or they will let you know that they only offer traditional Medigap insurance.

Finding The Right Price

You are well within your rights to look for the plan that is the cheapest, but you need to know what you are getting for the price that you have paid. More people who have issues with their insurance plans are paying too much, and they might pay so much in a year that they simply cannot afford to keep the insurance because it does not pay out enough in claims to justify the expense. You must look very carefully at these plans before signing up because their price matters.

Supplemental Insurance Claims

You must submit your supplemental insurance information to the medical office or facility where you are getting treatment because they can file your claims for you on the spot. They can send bills to both Medicare and the supplemental company, and both of these carriers will know what they pay for. They can make this process very fast for you, and they can save you a lot of time because you never have to file the claims on your own. This is a critical part of how you care for yourself because you might be too tired from getting care to handle your insurance. You can work with any supplemental company you want, and they will fill in the gaps of your coverage. You can also get extra help with Medicare Advantage plans, but please keep in mind that Advantage is a different program that operates under Medicare Part C.