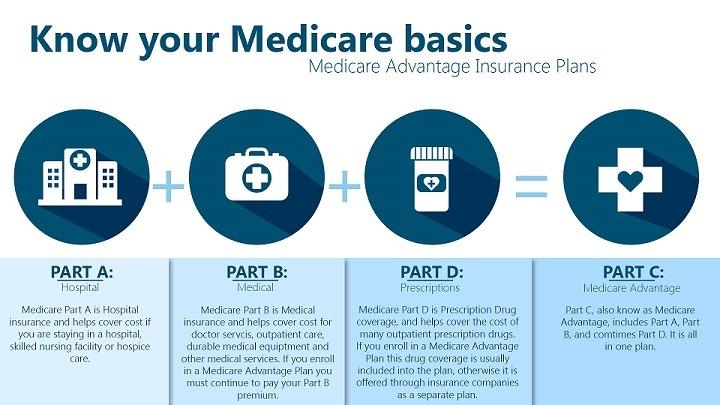

Understanding Medicare: Parts A, B, C and D. How Medicare Advantage Plans Work & What Each Covers

How to join a Medicare Advantage Plan

Before many of us become eligible for Medicare, we often think of Medicare as a one-note coverage that we will automatically have access to once we hit 65. That is only a tiny piece of an often complicated puzzle. In this article we are going to take a look at what is Medicare and all of its components, and how we can get in on it. According to figures from the CBO (Congressional Budget Office), as many as 10,000 people enroll in Medicare each day. This growing trend highlights the need for a deeper understanding of this type of coverage as it will one day affect us all at some point. You hear Medicare mentioned every time you turn on the TV, and many of us see ads on the internet all the time related to it. With most of the baby boomers at retirement age, is it any wonder why the topics of retirement and Medicare are so popular? With all of the buzz around Medicare, don’t you think it would be easier to understand? Unfortunately, it is just as confusing now, as it was ten years ago. But it does not have to remain that way.

So, What is The Difference Between all of These Medicare Plans Anyway?

Why do we keep hearing that this person has Part A or that person has Part B, or you are only covered for this with Part B, but not Part C? It goes on and on. What does all of this mean and can someone clear up the contrasts between all of these moving “parts”?.

What Are There Different Types of Medicare Plans And Why Are They Split Up?

Medicare is split into three groups: Original Medicare, Medicare Advantage, and Prescription Drug Coverage. Though they may often be referred to as plan types, they can also be classified as coverage types. Original Medicare plans are known as Parts A and B and are managed by the federal government. Medicare Advantage plans are classified as Part C. These are offered by private insurers. Finally, Medicare Part D is an optional coverage, also accessible through private insurance.

What is Medicare Part A?

Medicare Part A, the first one in this lineup, is also known as Hospital Insurance. The services that are covered are generally in the areas of hospital stays (inpatient), skilled nursing facility care, some nursing home care, hospice, and some forms of home health care. The coverage’s for part A are split into two categories: free premium and paid premium. If you worked long enough before enrollment, there is an excellent chance that you will not have to pay a monthly premium at all, for your coverage. There are also other circumstances that will make you eligible for a premium-free rate.

- If you are 65 or older, you could get your premium waived if:

- You receive Social Security (SS) retirement benefits or benefits from the Railroad Retirement Board (RRB).

- You are eligible for the above-referenced benefits and had not filed yet.

- You or your spouse were a Medicare-covered government employee.

- For individuals under 65 that qualify for the waiver, you must:

- Already have received SS or RRB disability benefits for a minimum of at least 24 months or 2 years.

- You have End-Stage Renal Disease (ESRD), in addition to other specific requirements.

If you don’t qualify for the free premium for Part A and choose to buy it anyway, you could pay as much as $422 monthly. That is for 2018 and can change from year to year. The rate is variable based on how many quarters you have paid Medicare taxes. Some people are auto-enrolled in Medicare Part A, depending upon their circumstances.

What is Medicare Part B?

Medicare Part B is Medical Insurance. This one covers doctors’ visits and preventative services, outpatient care and medical supplies. A lot of people are auto-enrolled for Part B, but if you are not, you must sign up for it or risk getting hit with a late enrollment fee. You do have to pay a premium for Part B, which can be auto deducted from your Social Security. The premium that you will pay is based upon your income; the Income-Related Monthly Adjustment Amount (IRMAA), to be exact. It’s based upon your adjusted gross income from your tax return. For 2018, you are looking at $134 or more for the premium. However, it can be less if you receive SS benefits, but not by much. It doesn’t end at the premium. You also have a deductible and coinsurance for Medicare Part B. The deductible for 2018 is $183 annually. The coinsurance is 20% out-of-pocket once the deductible is met for approved services. Let’s say that again, approved services. Many people get themselves in trouble on this one so make sure that your services are supported by Medicare, so you don’t end up in a bind.

What is Medicare Part C?

Medicare Part C consists of Medicare Advantage Plans offered by private insurance companies. These plan types can include HMOs, PPOs, Private Fee-for-Service Plans, and more. The benefit of enrolling in Part C is that it often covers what Parts A and B do not, and most of the services through Medicare are covered; meaning that you get all of the benefits of Parts A and B, in addition to the benefits of C. The out-of-pocket costs for Medicare Part C can vary. Some plans charge a premium, and some don’t. The same goes for the deductible. It often depends upon your plan, your doctor and whether or not you are in-network. For this coverage type, Medicare does not determine your costs. Your costs are determined by the plan you choose.

What is Medicare Part D?

Medicare Part D is the Prescription Drug plan. This plan is optional, and the costs will vary based on the plan you choose and the drug type. You must also pay close attention to whether or not your pharmacy is a part of your network. If you are having issues with paying for your medication, there is a program called Extra Help that will pay for the costs of your coverage. It is, of course, income-based. If you don’t happen to qualify, you can still contact Medicare to see what other options are available because some states do offer assistance programs. Other facts you should be aware of.

- Supplemental insurance is available. Medigap is a supplemental policy that can often cover services that Medicare will not pay for. It is mandatory for you to have Parts A and B to be eligible for Medigap. It does not cover your spouse, so you will need individual policies. You can obtain Medigap from a private insurer that is licensed to offer it. If you already have Medicare Advantage, you must leave that plan before your Medigap coverage starts. Some services are still not covered so make sure to verify first, before enrolling. Just like with Medicare Advantage, prices will vary.

- Medicare can work with other insurance. Based on the coordination of benefits rules, the carriers decide who should pay first. One will be the primary payer and the other, the secondary. There can even be a third payer.

- Long-term care is not covered. It’s not covered by Medicare, nor Medigap and is not covered by most health insurance plans. If you want to be sure about what is included and what isn’t, go the Medicare website online and search for coverage information based upon the item or service type.

- Assistance is available. If you are still having trouble putting the pieces of the giant puzzle together regarding Medicare and its rules and coverage’s, contact the State Health Insurance Assistance Program (SHIP) for your state. SHIP is available to answer any questions or address any concerns you are struggling with.

Recap On What We Have Learned

Whatever path you decide to take on this Medicare journey, there is an abundance of resources available at your fingertips for any questions you may have. It does not have to be difficult. Do your homework first. Some essential tips to take with you:

- Make sure your doctor accepts Medicare.

- Check with your pharmacy to ensure they accept your plan (whether Medicare Advantage or Part D).

- Always check to see if a service or future test is covered.

- Check with your state to see if any assistance programs are available.

- If you are traveling, you might be outside of your network. It does not hurt to check first.

Medicare education does not have to be rocket science. If you take it in by small pieces, it’s a lot easier to digest. When you look at it as a whole, yes, it can be overwhelming. Just look at it one section at a time, and it starts to make a lot more sense. While these facts and figures may not cover every single detail, they do help with a high-level overview of the wide world of Medicare. All of its moving parts are pieces of a larger puzzle. Hopefully, you have gained further insight, helping you to understand the basic ins and outs of Medicare better.