How To Effectively Save Money On Medigap Plans Today and Get The Coverage You Need

How Much Can a Medigap Plan Save Me?

Going to the doctors these days can bring a lot of fears, other than a fear of doctors themselves. In this article we will talk about saving money on Medigap plans is quite important as users must ensure they have coverage that will fill in the blanks in their traditional Medicare. Anything supplemental must be ordered to ensure the coverage will fill in the gaps for the user, and someone who wishes to order coverage must look at what it does for them. This article explains how the Medigap plans will become cheaper when the user is looking at a way to ensure they pay for nothing.

Medicare Is Free

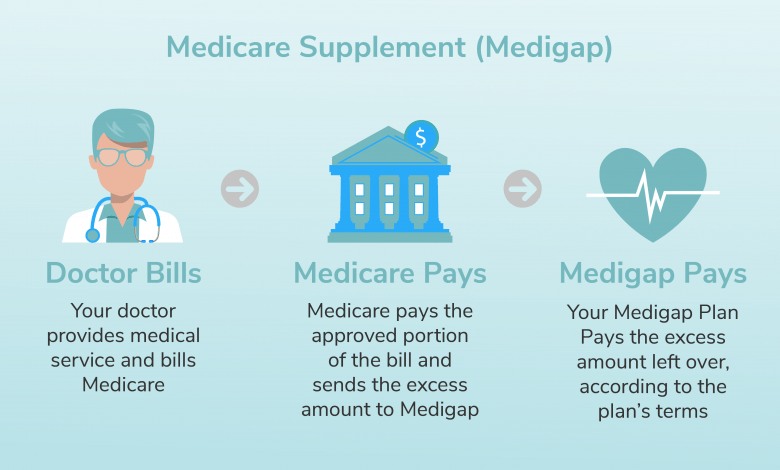

Medicare is a free service that is paid for through taxes, and the user may have 100% coverage when they are using their supplemental plans. They may offer insurance information to those who offer services, and the claims will be filed to Medicare and their supplemental carrier. Medicare is free, but the user must pay a monthly premium for Medigap.

Why Supplemental Insurance?

Medicare users do not have 100% coverage at all times, and there are many times when the supplemental plan will pay for a small amount of what was required. The supplemental plan may rise in price if it used quite a lot, and someone must ensure they are using the supplemental plan at every location if they are using. The finest supplemental plans will ensure customers have the coverage they need, and they will be used automatically when the bill for services goes over what Medicare will pay for. The office will ensure it is used when necessary, and the customer must search for a plan they find helpful.

Shopping Around

Shopping around for coverage is quite important as they are many different companies that offer supplemental insurance. The supplemental coverage that is given to customers will help them ensure they may pay for all the care they need, and they will find it easy to pick the plan that is the lowest price and offers the most help. The customers who shop around will find it simple to compare when they are purchasing. The supplemental plans must be chosen using information found online, and the user must begin checking before they are stuck with a bill where Medicare did not cover everything.

The Plans Have Their Own Coverage Ranges

There are many plans that have a range of coverage options, and the customer may ask the company how much they will cover given how much Medicare covers. These companies know how to manage the care of their customers, and they are aware of how much is covered. The people who are using a Medigap plan must ensure they have used it at every place they go for care. The office must have information for the coverage, and they must ensure they have checked the coverage before it is claimed. The patient may be given extra information about their coverage, and they will find it simple to find the plan they believe is the best for them.

Choosing The Cheapest Plan

The cheapest plan will ensure the user may find a gap in coverage that is easy to fill. Someone who is searching for better insurance will quite enjoy the way they feel when they use their supplemental insurance in a medical office, and they will not be surprised by bills they must pay after the fact. Someone who wishes to use the supplemental insurance may shop around for the coverage they need, and they will find it simple to order something that will help them save money on their medical care. The care needed for everyone is paid for with Medicare and the Medigap plan chosen by the customer.

High Deductible Can Be Good

Though it might seem like a cumbersome thing to do, having a higher deductible can be a great thing in the long run for senior citizens. This is because plans that have higher deductibles typically have lower premiums, meaning that you can save a lot of money if you’re willing to pay the deductible up front. If you’re not familiar with the concept of a higher deductible, it essentially means that you have to pay for a certain amount of money each year by yourself. Once you pay off this balance, though, the insurance covers the rest of the year’s treatment, meaning that you can save a good deal of money if you have enough appointments to warrant a high deductible. Since you’ll be paying a cheaper monthly premium, you also won’t have to worry about money as much for the rest of the year after paying off your deductible.

Names Don’t Mean Much

When you hear the word healthcare, which companies do you think of? It’s likely that you typically think of companies such as United Healthcare, Cigna, and a few other of the top name brands. While there’s something to be said about going with a company that you feel is reliable, this doesn’t necessarily mean that working with one of the top brands is the right thing to do. In fact, you might even be paying more money for a similar service to off-brand Medigap plans, with a lot of the price being allotted to the brand name itself. So, look into off-brand Medigap plans—you’ll be surprised at what you can save! The need for an insurance plan does not mean that you have to settle for something that isn’t the best option for you!

Get a New Plan While You Can

For some senior citizens, switching insurance isn’t the easiest thing in the world. Many policies don’t want new customers who are well into old age, but there are two factors to keep in mind when switching to new insurance:

- Are you healthy?

- Are you under 70 years old?

If you answered “yes” to both of these questions, there’s a high chance that you’ll be able to find a plan that is actually cheaper for you in the long run! You might think that the financial difference isn’t that significant, but it really is. For example, it’s very easy to save at least a few thousand dollars on choosing a cheaper plan if you’re healthy and under the age of 70!

Check Your State’s Rules

Just because you’re over the age of 70 or unhealthy, doesn’t mean that you have to settle for the same insurance you’ve always had! What many people don’t realize when looking into a new type of health insurance is that the state in which you live might have specific insurance-related laws that can be incredibly helpful. For example, certain states require that you can switch to a cheaper version of your plan within 30 days of your birthday if you desire, while other states even allow you to switch your Medigap plans at any point in your life. Being familiar with the plans of your specific state can be a great way for you to switch plans if possible!

Work With a Broker You Can Trust

In understanding the healthcare system, there’s no better ally for a senior citizen than a health insurance broker who knows their stuff. Not only will they make the process of shopping around more intuitive, but they’ll be able to answer any questions you might have about any potential Medigap plans you’re looking into. Here are some ideas on where you can find a good insurance broker:

- Ask your family & friends

- Contact local retirement centers and ask

- Read reviews online

Which brings us to the next point…

Don’t Be Afraid to Ask Questions

Though it might seem like your insurance policy is the be all, end all assessment of what Medigap is used for, you have to understand all of it before you purchase it. If you happen to not understand something or not want to pay a certain bill, just ask! You’d be surprised at how many aspects of healthcare service can be opted out, allowing you to save even more money. For example, if you don’t need dental care in your Medigap plan, make sure that it isn’t in the deal that you sign! After all, dental care isn’t just what Medigap is used for. There are often many hidden costs that can be difficult to notice when you’re caught up in the need for an insurance plan, but staying on top of questioning what you’re signing is always a good way to stay awake and eventually save some serious money.

Be Prepared for Anything

One of the reasons as to why healthcare is so serious for senior citizens is because there is often many possibilities for unexpected complications to arise, resulting in the need for an insurance plan. Old age might be a touch unpredictable, but this does not mean that you have to be caught off-guard. For instance, being able to take care of yourself on your own terms can actually be a great way to save money off of your healthcare. Your free annual physical is a great time to check in about your health, allowing you to get plenty of assessments free of charge. This can also be a great time for doctors to raise any concerns they might have about your overall health, so be sure to get the most out of this free appointment. Who knows, you might have health complications down the road that could have been predicted if you asked a doctor beforehand! Ultimately, staying prepared for anything is one of the best ways you can ensure you won’t have costly healthcare bills later on in the year. In fact, one could say this is exactly what Medigap is used for!